I. Course

Subject: Basic Risk Management

Trainer: Jorge E. Dioneda

II. OBJECTIVES

Course Objectives:

- To support Financial Institutions in reviewing existing tools on pandemic and developing new one.

- Enable banking personnel to be agile in managing risks related to pandemic and other scenarios.

- To benchmark best practices in managing risk: Operational, Credit , Liquidity and Market.

Terminal Objectives:

- Understand the Risk Management discipline, its history, definitions, the different areas and the general & specific frameworks.

- Learn the application of Risk Management tools for different types of financial institutions.

- Appreciate the value of risk management tools and processes for each business and overall corporate entity.

- Learn the recent significant key regulations of BSP and how they are applied.

- Learn the trends in financial technology (digital banking) and the practices in managing its risks.

- Explore the use of Risk Management Tools in an actual / scenario risk events.

- Comprehend personal risk appetite and capacity.

III. SCOPE AND LIMITATIONS

The course will cover the end-to-end general view and tools of risk management. Detailed application of different risk management tools will be covered in another course.

IV. PROGRAM OF INSTRUCTION

General Coverage

- Day 1 (AM) – General Concept of Risk, Risk Management, and Enterprise Risk Management Framework & its components.

- Day 1 (PM) – Pre-Covid19 and Covid19 Era:

- Top Tools: BCP, Contingency Funding Plan and Risk Forecasting

- Refresher on BCP, Contingency Plan and Risk Forecasting

- What’s Happening Today: People, Processes, System and Industry Impact.

- New Approaches in Managing Covid19 Challenges and the Risk Management Roles and Responsibilities.

- Day 2 (AM) – ERM Implementation

- Operational Risk Management (ORM) and other Risks

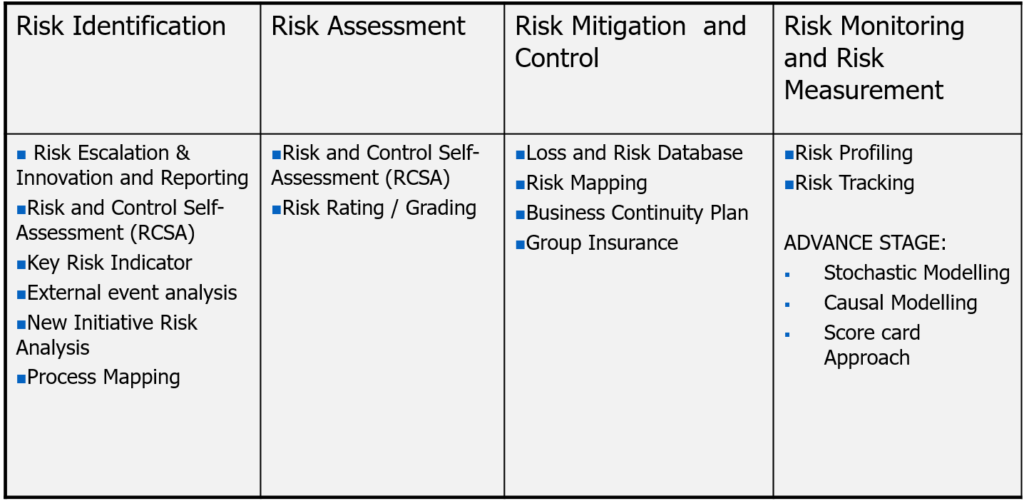

- ORM Framework, Tools (Schedule 1) and Processes

- ORM in Covid19 period and beyond: Reassessment and Recalibration

- Operational Risk Management (ORM) and other Risks

- Day 2 (PM) – ERM Implementation

- Credit Risk Management (CRM)

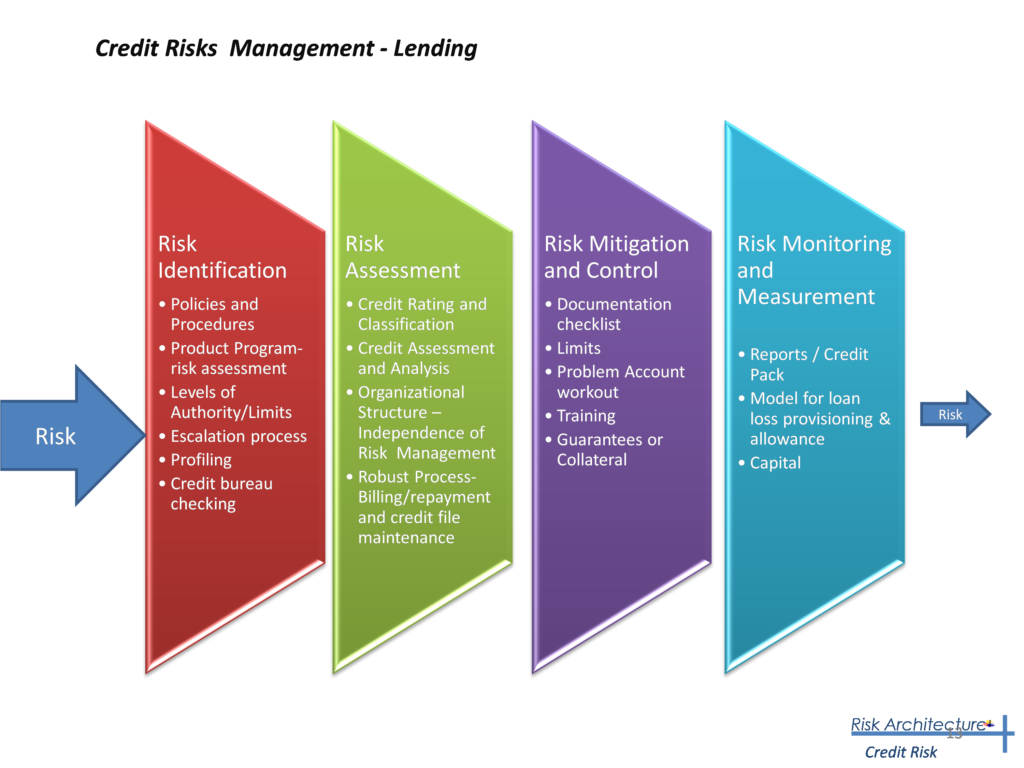

- CRM Credit Tools (Schedule 2) and Processes

- CRM in Covid19 period and beyond: Revalidation and Recalibration

- Market Risk Management (MRM)

- MRM Framework, Tools and Processes

- Credit Risk Management (CRM)

- Covid19 and Beyond: Recovery Initiatives

Schedule 1: ORM Tools

Schedule 2: CRM Tools

LMS Options

LMS Options